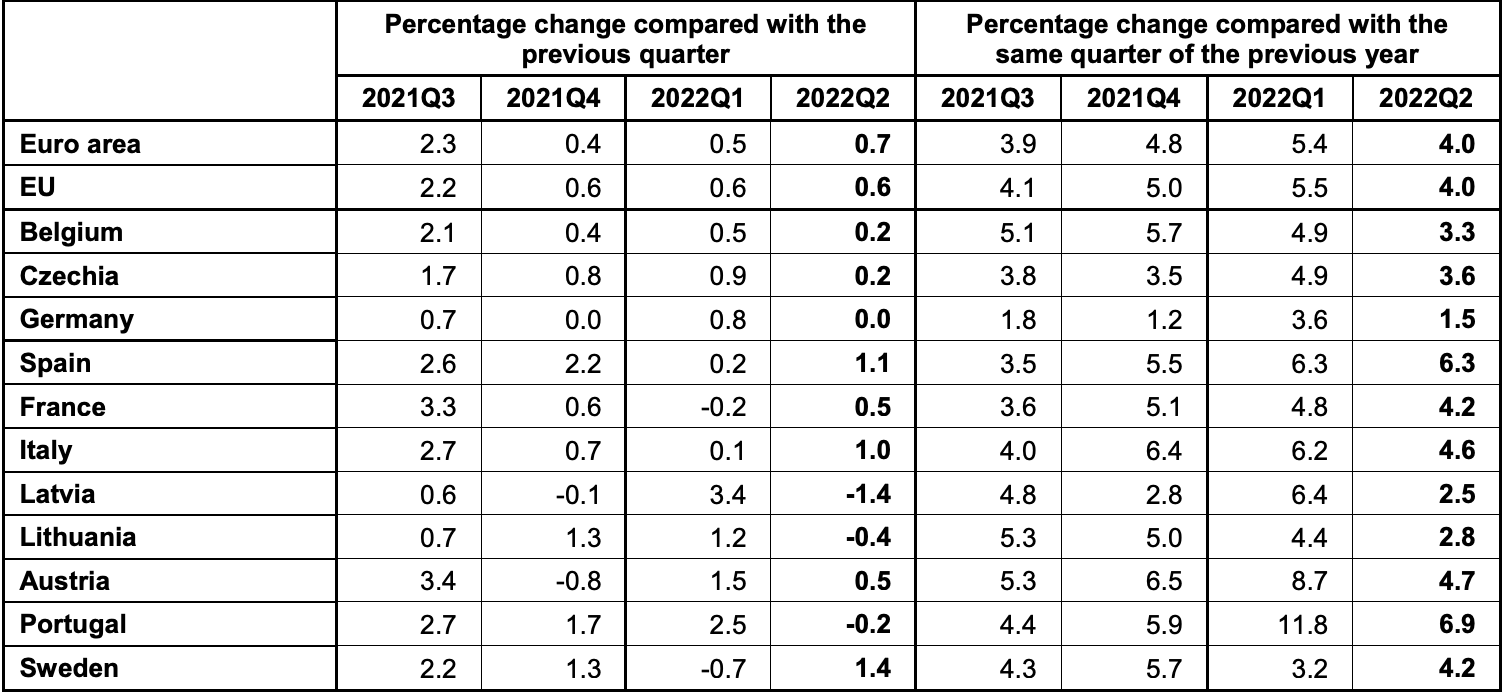

The euro area GDP grew by 0.7% over the last quarter while the European Union grew by 0.6% according to the just released data by Eurostat, the statistical office of the European Union.

Europe moreover continues to see record breaking growth over the same quarter of the previous year, up 4% in the euro area and in the EU over Q2 2021.

These are at annualized rates, so in this quarter the GDP grew 1% over the 3.5% it grew last spring.

Making this the highest level of growth in Europe since the European Union was formed in the late 90s.

Sweden saw the biggest expansion quarter over quarter, growing by 1.4%, together with Spain and Italy which both grew at about 1%.

Comparing apples to apples, Spain and Portugal are seeing 6.3% and close to 7% growth over Q2 2021, China level growth.

Germany on the other hand is growing at just 1.5%, US levels, while both France and Italy are seeing good growth at 4.2% and 4.6%.

So tourism is back on, but both Austria and Sweden are seeing good growth even though neither has them sunny beaches.

The slowdown in Germany therefore is probably due to the energy transition, with both Latvia and Lithuania seeing a sharp slowdown quarter on quarter, though still growing somewhat decently over last year.

A Booming Europe

The EU’s GDP has reached an all time high of $17 trillion last year, putting it almost on par with US’s $22 trillion if we include UK’s $3 trillion GDP.

After significantly lagging behind America and China for years, US and Europe are once again pretty much peers on the economy, taking first and second position.

Europe’s growth moreover is continuing to expand, while US saw a contraction quarter over quarter, but still growing, though just 1.6% over Q2 2021.

That’s still better than China’s brink of recession with just 0.4% growth over Q2 2021. Europe thus, for now, is leading the world economy.

If the last line in the featured chart above can be held at these levels, then Europe will get out of the long stagnation.

Germany however is already back to sclerotic growth. Energy is one reason and, if that’s the case, it should be temporary through the transition over a year or two.

US is also back to sclerotic growth, but that’s mostly due to interest rates there rising to 2.5%, while in the euro area they’re still at 0.5%.

The European Central Bank (ECB) has gone slower, and that’s one of the main reason why Europe as a whole continues to see proper growth, while the US economy is back to sclerotic growth.

The next FED and ECB meetings, therefore, may well be the most delicate ones yet. For ECB, any hike above 0.25% risks following US into effectively stagnation, something that may well mean trouble as we have seen over the last decade with the rise – and now fall – of nationalism.

For FED, the quarter on quarter slowdown and the return of stagnation should be ringing alarm bells.

They’ve gone too fast, and now that interest rates there have reached 2.5%, it may well get dangerous to hike them any further at all as a recession then would probably be inevitable.

Source: https://www.trustnodes.com/2022/07/29/europe-grows-0-7