Add another voice to the growing chorus of naysayers about the staying power of the recent rally in U.S. equities.

The stock market’s rally since the Federal Reserve’s last jumbo rate hike in late July looks increasingly out of sync with macro fundamentals, particularly the roaring U.S. labor market, economists at Mizuho Securities warned on Monday.

While many investors have been betting on the Fed to pivot away from its aggressive rate-hiking stance next year, they risk “ignoring a host of important considerations,” Steven Ricchiuto, chief U.S. economist at Mizuho Securities and Alex Pelle, U.S. economist, wrote in a Monday client note.

“For starters, the anticipated reversal in policy in 2023 requires a highly unusual deceleration in inflation from the over 9% year-over-year rise reported last month,” the team wrote.

“Alternatively, a 2023 reversal in policy could be triggered by an unforeseen financial debacle, but these types of dislocations are never good for risk assets, so again the equity rally looks out of sync with the macro fundamentals.”

Furthermore, approval by Senate Democrats on Sunday of the ກົດໝາຍວ່າດ້ວຍການຫຼຸດຜ່ອນເງິນເຟີ້, a big healthcare, climate and tax package, which includes some corporate tax increases, “suggests the markets need to take onboard a tighter fiscal policy on top of the ongoing Fed tightening,” the team wrote.

President Biden on Monday called the bill a measure that’s “going to immediately help,” including provisions that include a $2,000 cap for seniors on prescription drug costs.

But Ricchiuto and Pelle warned the bill also risks pulling down corporate growth and earnings. “As such, we see the recent rally as another bounce within a bear market that should run out of steam before 4200 on the broad market index implying that this is now the upper end on the trading range.”

ດັດຊະນີ S&P 500

SPX,

closed lower on Monday, after Friday booking its best three-week percentage gain since April 1, according to Dow Jones Market Data. The index still was down 13.1% on the year, ending at 4,128.97 Monday, according to FactSet.

U.S. bond markets also have rallied from their worse levels of the year, in part as the 10-year Treasury rate

TMUBMUSD10Y, ທ.

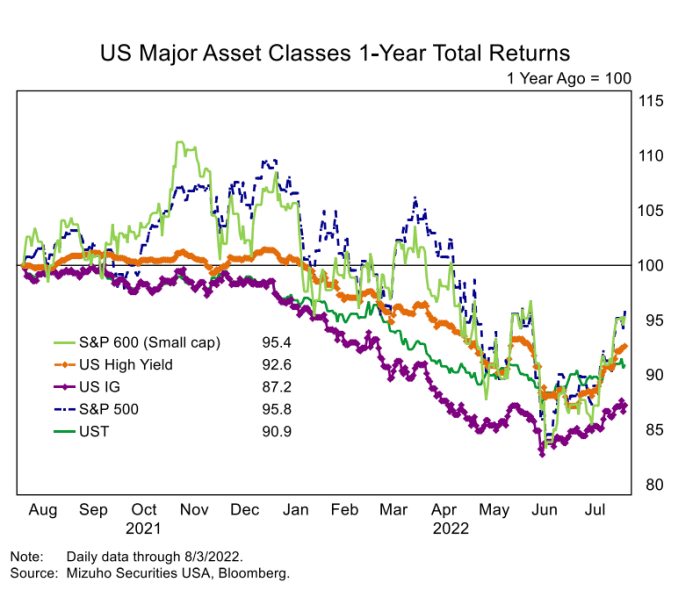

has found somewhat of a footing above 2.7%. Specifically, while the U.S. investment-grade corporate bond market was at a negative 11.5% annual total return through Aug. 4, its performance has improved from its June low (see chart).

Stocks, bonds are improving from worst levels in past 12 months

ຫຼັກຊັບ Mizuho

Even so, Mizuho’s economists said that investors “discounting of rate cuts by the bond market in 2023″ suggests that investors “are betting the labor market is

ready to crack which the data does not show.”

To be sure, the scope of the market’s move is attracting attention. Strategists at Jefferies noted the S&P 500 was on the verge of sending a signal that has tended to precede big market moves, albeit in either direction.

ອ່ານ: ຕະຫຼາດຫຼັກຊັບທີ່ເພີ່ມຂຶ້ນແມ່ນຢູ່ໃນຂອບເຂດຂອງສັນຍານການເຄື່ອນໄຫວ 'ຂະຫນາດໃຫຍ່' - ແຕ່ມີການຈັບໄດ້

Mizuho’s team still urged caution, saying it would take a “major and sustained” break in the labor market for the Fed to reverse its inflation-fighting course.

ເບິ່ງ: Suddenly, stock-market investors are wrestling with ‘boomflation’ after hot July jobs report

Source: https://www.marketwatch.com/story/why-the-s-p-500s-bounce-within-a-bear-market-could-fizzle-before-it-hits-4-200-11659986806?siteid=yhoof2&yptr=yahoo