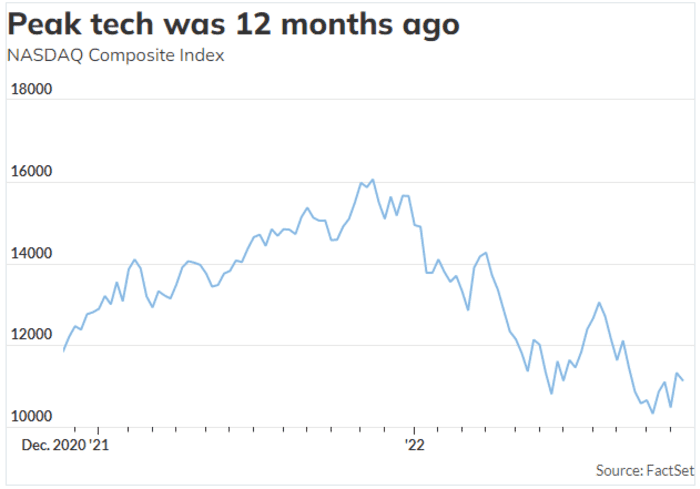

This weekend a year ago the Nasdaq Composite hit a record high. And why not. The Fed Funds rate was then effectively zero, while the central bank continued to buy assets, pumping liquidity into the market. Inflation, Fed chair Jay Powell insisted, was “transitory.”

It was not. Powell has since raised the cost of borrowing to a top of range 4%. He’s now shrinking the central bank’s balance sheet. So the Nasdaq

ຄອມພີວເຕີ,

is off 30.6% from that peak.

Where to now? Can the recent rally propelled by indications of cooling inflation be sustained? Well, many traders seem wary about betting on any traditional festive surge, as shown by some funny stuff going on in options markets.

The CBOE Equity put/call ratio jumped to 1.46 midweek, way above even the 1.3 registered during the market turmoil in March 2020, and an indication traders were eagerly seeking protection from a market fall . The next day the ratio fell back to 0.73, however.

But it’s Friday, so let’s take the positive from this. A spiking put/call ratio is often seen as a contrarian indicator, a sign investors are too pessimistic.

In fact if we’re embracing such optimism, let’s go the whole hog and seek out the latest thoughts of Tom Lee, the analyst for whom “The Glass Half Full” would be the name of his pub.

Lee, head of research at Fundstrat, in a note published late Thursday reiterates a batch of reasons why stocks can rally from here.

First, the cooling October consumer prices figure was a “game changer,” because it was repeatable, with softening in three important areas; shelter, medical care and goods like apparel and used cars.

“We expect this to be sufficient for Fed to slow pace of hikes, and possibly December 2022 may be the last hike,” says Lee.

Second, the recent sharp move lower in 10-year Treasury yields

TMUBMUSD10Y, ທ.

likely portend further declines, which in turn are supportive of the expansion of stocks’ p/e multiples.

Indeed, the calmer conditions in bond markets of late — as measured by the CBOE 20+Year Treasury Bond Volatility ETF (VXTLT) — is also helping support equities. The VXTLT has dropped from 33 to 23 in just four weeks and “this collapse in volatility, in our view, would support S&P 500 surging to 4,400-4,500 before year end,” says Lee.

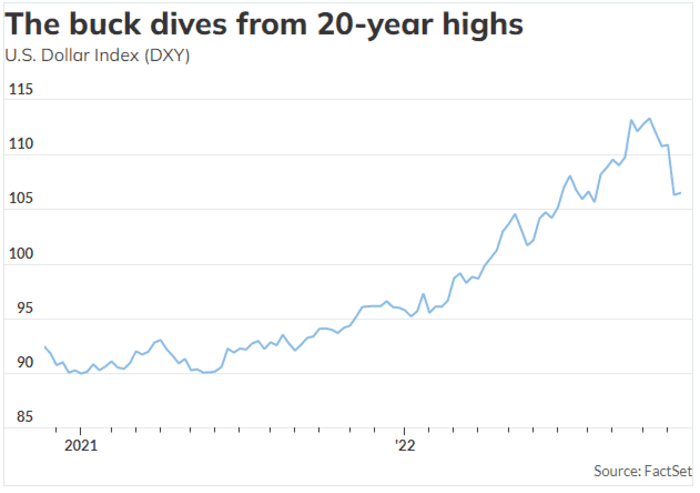

Next, the dollar index’s swift 6.5% retreat from the 20-year high touched in late September, speaks to easing market tensions and provides a more hospitable environment for U.S. corporate earnings.

Lee has also taken comfort from the fact that the stock market has shown little evidence of being derailed by the FTX implosion, with few signs of crypto contagion affects despite “300,000 accounts with leverage and the stranding of $10 billion or more in assets”.

“This shows that investors are becoming more discerning, rather than ‘hit the sell button’ on any bad news.”

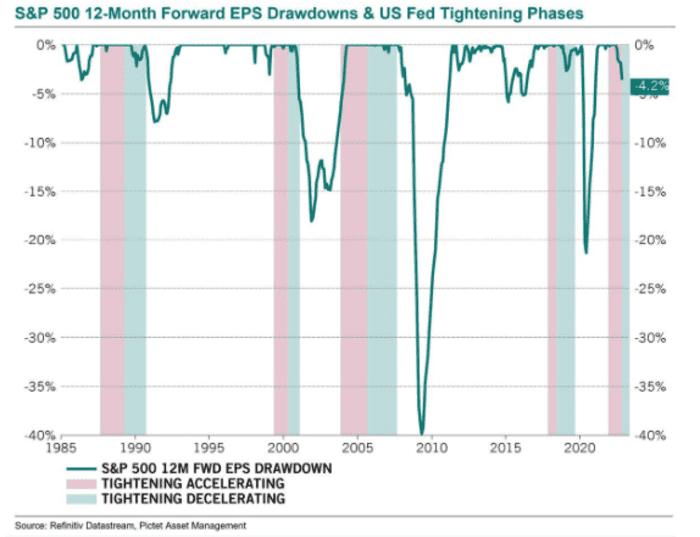

Finally, Lee challenges the view that investors will turn attention away from monetary policy and start to fret about how much a slowing economy will impact company earnings.

“Skeptics will say ‘growth is the problem now’ and point to downside in earnings per share. But [the] S&P 500 has historically bottomed 11-12 months before EPS

troughs.”

ຕະຫຼາດ

Stocks were set to open higher on Friday, with the S&P 500 future

ES00,

up 0.9% to 3992. Ten-year Treasury yields

TMUBMUSD10Y, ທ.

rose 2.1 basis points to 3.792% as investors continued to absorb a suggestion from a Fed official that interest rates could rise to 7%. U.S. crude futures

CL.1,

fell 2.2% to $79.92 a barrel.

ບ້ານໄດ້

Shares in Palo Alto Networks

PANW,

are up 8% in premarket trading after the cybersecurity company delivered well-received results and gave an upbeat outlook after Thursday’s closing bell.

In contrast Williams-Sonoma stock

WSM,

is losing 7% after the homeware retailer warned of macro uncertainty impacting sales in coming years.

Twitter workers quit, offices shuttered, amid “hardcore” uproar on the conditions laid out by Elon Musk. Shares in one of Musk’s other ventures, Tesla

TSLA,

rose in premarket trade.

Boston Fed President Susan Collins is due to talk about the labor market at 8:40 a.m. Economic data on Friday include the October existing homes report and leading economic indicators, both due at 10 a.m.

Further signs that the crypto bros are not minded to look after their own as Binance boss Changpeng Zhou continues to tear into Sam Bankman-Fried, former leader of collapsed FTX.

Germany’s biggest trade union has agreed an 8.5% pay rise in the wake of record high inflation.

Sweden said traces of explosive have ben found at the site of two pipelines that used to carry gas from Russia to central Europe.

Qatar got the World Cup because it said it would hold it in the summer with beer. Now it’s taking place in the winter without beer.

ດີທີ່ສຸດຂອງເວັບ

Masayoshi Son owes $4.7 billion to SoftBank following tech rout.

Fading supply-chain problems signal season of plenty for holiday shoppers.

The meltdown in crypto is not just the fault of FTX.

ຕາຕະລາງ

All the equity bulls want a Fed pivot. But what would that really mean for stocks after any initial euphoric pop? Well, given Fed speakers keep saying they will squeeze inflation until the economic pips squeak, it may mean that by the time the Fed is considering easing off the brake the environment for businesses already could be particularly grim. The chart below from Pictet Asset Management via ChartStorm, shows how S&P 500 earnings per share are impacted during periods when Fed tightening is accelerating and decelerating. Message to market: when the Fed finally gives you what you craved, you may wish you weren’t getting it.

Source: ChartStorm

ຍອດນິຍົມ

ນີ້ແມ່ນຕົວຕີກເກີຕະຫຼາດຫຼັກຊັບທີ່ມີການເຄື່ອນໄຫວຫຼາຍທີ່ສຸດໃນ MarketWatch ຕັ້ງແຕ່ເວລາ 6 ໂມງເຊົ້າຕາເວັນອອກ.

| Ticker | ຊື່ຄວາມປອດໄພ |

| GME, | GameStop |

| TSLA, | Tesla |

| CMA, | AMC Entertainment |

| ເດັກຊາຍ, | NIO |

| AAPL, | ຈາກຫນາກແອບເປີ |

| ຫຼາຍ, | Mullen ຍານຍົນ |

| AMZN, | Amazon.com |

| ບີບີ, | ຫ້ອງນອນແລະນອກ ເໜືອ ໄປ |

| APE, | AMC Entertainment ມັກ |

| ບາບາ, | ອາລີບາບາ |

Random ອ່ານ

Sheep going round in circles – for 12 days!

A $50 mug is the new office status symbol. No, really!

ຕ້ອງການຮູ້ເລີ່ມຕົ້ນແລະຖືກປັບປຸງຈົນກ່ວາລະຄັງເປີດ, ແຕ່ວ່າ ລົງທະບຽນຢູ່ທີ່ນີ້ ເພື່ອໃຫ້ມັນສົ່ງໄປທີ່ອີເມວຂອງທ່ານຄັ້ງດຽວ. ສະບັບອີເມວຈະຖືກສົ່ງອອກໃນເວລາປະມານ 7: 30 ເຊົ້າພາກຕາເວັນອອກ.

ເຊີນຟັງ ແນວຄວາມຄິດໃໝ່ທີ່ດີທີ່ສຸດໃນ Money podcast ກັບນັກຂ່າວ MarketWatch Charles Passy ແລະນັກເສດຖະສາດ Stephanie Kelton

Source: https://www.marketwatch.com/story/a-year-after-the-nasdaq-peak-why-stocks-could-rally-from-here-11668771691?siteid=yhoof2&yptr=yahoo