ແຕ່ລະອາທິດພວກເຮົາກໍານົດຊື່ທີ່ມີລັກສະນະອ່ອນເພຍແລະອາດຈະນໍາສະເຫນີໂອກາດການລົງທຶນທີ່ຫນ້າສົນໃຈໃນດ້ານສັ້ນ.

ການນໍາໃຊ້ການວິເຄາະດ້ານວິຊາການຂອງຕາຕະລາງຂອງຫຼັກຊັບເຫຼົ່ານັ້ນ, ແລະ, ເມື່ອເຫມາະສົມ, ການປະຕິບັດທີ່ຜ່ານມາແລະຊັ້ນຮຽນຈາກ TheStreet's. ອັດຕາປະລິມານ, ພວກເຮົາສູນຢູ່ໃນສາມຊື່.

ໃນຂະນະທີ່ພວກເຮົາຈະບໍ່ຊັ່ງນໍ້າ ໜັກ ກັບການວິເຄາະພື້ນຖານ, ພວກເຮົາຫວັງວ່າຊິ້ນສ່ວນນີ້ຈະເຮັດໃຫ້ນັກລົງທຶນສົນໃຈໃນຮຸ້ນໃນຈຸດເລີ່ມຕົ້ນທີ່ດີເພື່ອເຮັດວຽກບ້ານຕໍ່ໄປໃນຊື່.

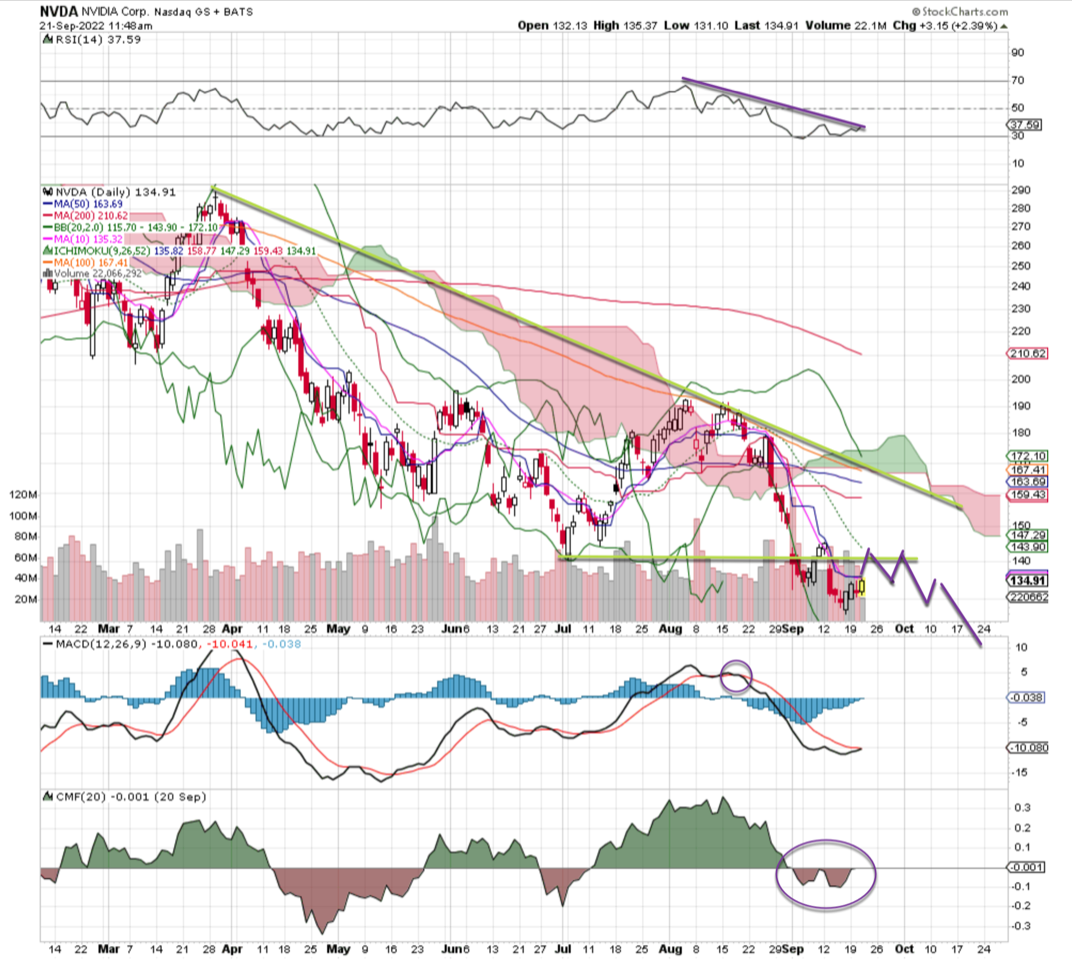

Nvidia Isn’t Computing

Nvidia Corp. (NVDA) ບໍ່ດົນມານີ້ໄດ້ຫຼຸດລົງເປັນ ຖື ດ້ວຍຄະແນນ C + ໂດຍ TheStreet's ອັດຕາປະລິມານ.

ປະຕິບັດການແຈ້ງເຕືອນ PLUS recently cut this name due to a severe breakdown and poor earnings, and the semiconductor maker was downgraded by Quant Ratings as the technicals continue to erode badly. Money flow is back to negative, and while a few up sessions might alleviate some of the oversold condition the trend is clearly down.

The cloud is red and moving average convergence divergence (MACD) is on a sell signal while the chart shows a consistent flow of lower highs and lower lows. When does it stop? That’s not our concern.

Put in a stop at $155 and target the $105 area.

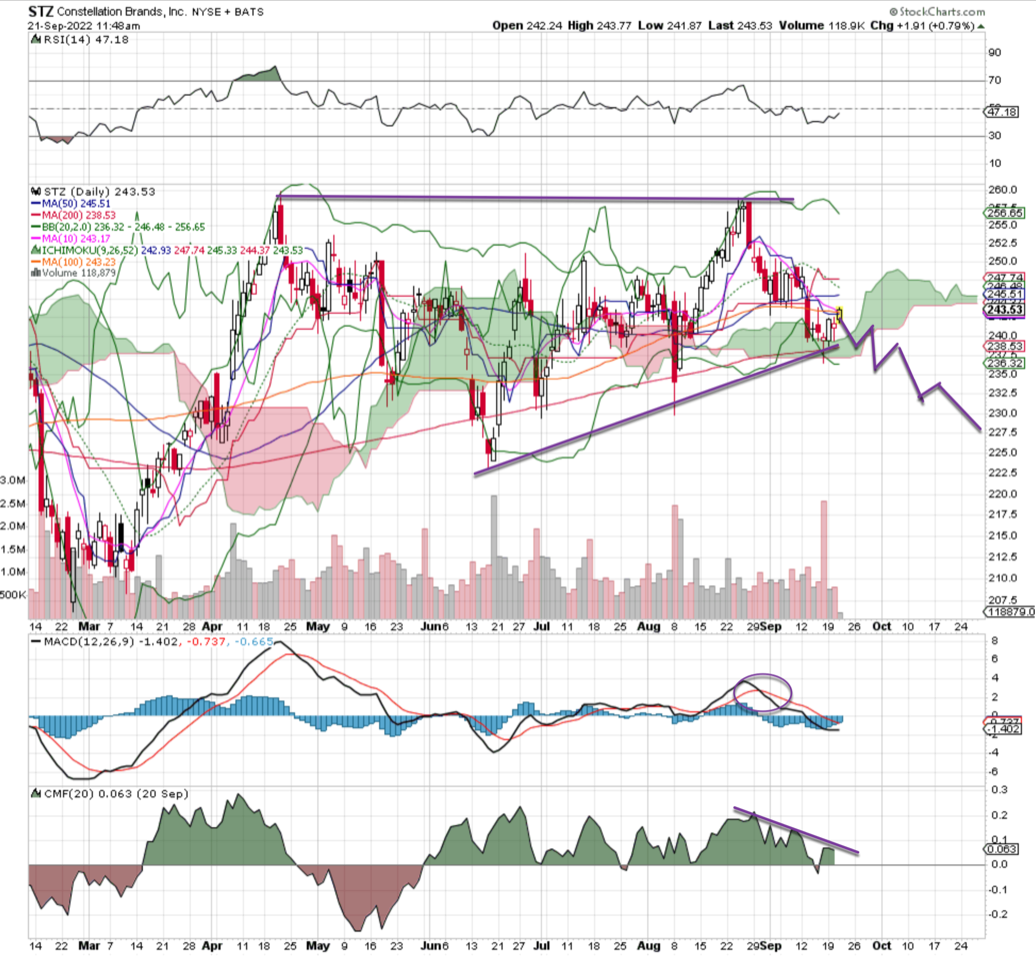

ຍີ່ຫໍ້ Constellation ໄປແປ

Constellation Brands Inc. (STZ) ບໍ່ດົນມານີ້ໄດ້ຫຼຸດລົງເປັນ ຖື ດ້ວຍຄະແນນ C + ໂດຍ TheStreet's ອັດຕາປະລິມານ.

The beer, wine and spirits maker generally is one of those go-to names during good and bad times, but its chart is starting to become challenged. The support line (rising) has been helpful of late, but we can see clearly the double top formed from April and August, with high volume around those two rejection areas. This 200-day moving average test is critical for the bulls, but it may not hold for long.

MACD is on a sell signal while money flow is leaking out of the faucet. We easily can see more downside; put in a stop at $250 and target the $227 area.

Kraft Heinz Looks Cheesy

Kraft Heinz Co. (ຄກລ) ບໍ່ດົນມານີ້ໄດ້ຫຼຸດລົງເປັນ ຖື ດ້ວຍຄະແນນ C + ໂດຍ TheStreet's ອັດຕາປະລິມານ.

The food and beverage maker remains under pressure, and with a series of lower highs and lower lows the trend is clearly down.

Take a look at money flow, which has flipped bearish, while the MACD is on a sell signal. Also, the Relative Strength Index (RSI) is bending downward with a steep slope, telling us more downside pressure is coming.

The recent pull-up is an excellent spot to start a short; target the $29 area and set a stop at $36 just in case.

(ຜູ້ປະກອບສ່ວນເງິນທີ່ແທ້ຈິງ Bob Lang ແມ່ນຜູ້ຈັດການຫຸ້ນສ່ວນຂອງ TheStreet's ປະຕິບັດການແຈ້ງເຕືອນ PLUS. ຕ້ອງການແຈ້ງເຕືອນກ່ອນ AAP ຊື້ ຫຼືຂາຍຮຸ້ນບໍ? ຮຽນຮູ້ເພີ່ມເຕີມດຽວນີ້.)

ໄດ້ຮັບການແຈ້ງເຕືອນທາງອີເມວທຸກໆຄັ້ງທີ່ຂ້ອຍຂຽນບົດຄວາມ ສຳ ລັບເງິນທີ່ແທ້ຈິງ. ກົດປຸ່ມ“ + ຕິດຕາມ” ຕໍ່ກັບເສັ້ນທາງຂອງຂ້ອຍຕໍ່ບົດຄວາມນີ້.

ທີ່ມາ: https://realmoney.thestreet.com/investing/stocks/bearish-bets-3-stocks-you-should-consider-shorting-this-week-16103318?puc=yahoo&cm_ven=YAHOO&yptr=yahoo