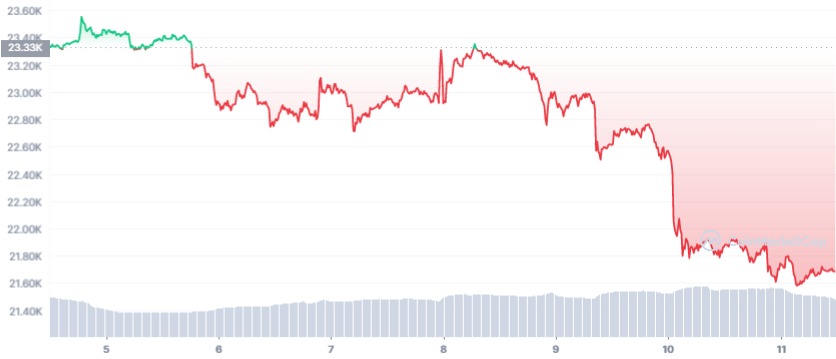

- Kraken trading volume slipped more than 35% in the last 24 hours

- Analysts say that the market may mirror the impacts of the SEC ruling

- Bitcoin trading volume slipped by 22% in last 24 hours

Kraken, the world’s third-largest crypto exchange in the context of its trading volume, was criticized for selling unregistered securities with the help of its staking programs.

The Securities and Exchange Commission clamped on cryptocurrency exchanges that offer users returns with their latest regulatory move on February 9, 2023. SEC charged the third largest crypto exchange by volume for selling unregistered securities.

Kraken was founded in 2011 and was among the first crypto exchanges that entered the crypto sector. The exchange offers to trade 100+ crypto assets and 6+ fiat currencies, including USD and EUR.

The US-based cryptocurrency exchange paid the SEC a $30 million fine to settle the charges. Furthermore, the exchange announced that it is ending its staking service scheme.

The staking service is particularly a process wherein the user locks their funds on the exchange. The locked tokens are then used to validate blockchain data Once all of this is said and done, the user who locked his assets is rewarded with an extra amount.

They get rewarded with more tokens in return for processing transactions. Most crypto stakers loan their tokens to the service provider operating the nodes and shares in return.

The chairman of SEC appeared on CNBC’s “Squawk Box” He noted, “Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.”

Gary Gensler said that other crypto exchanges should “take note” and come into compliance. The statement sounds like the chairman of SEC wants to say that other exchanges may learn a lesson from Kraken and stop such services as early as they can.

Coinbase, the second largest crypto exchange, said its staking service has no negative impact of this action by U.S regulator. Paul Grewal, the Chief Legal Officer of Coinbase, said, “What’s clear from today’s announcement is that Kraken was essentially offering a yield product.”

In 2023 Bitcoin was moving on a positive path, but by the end of January and starting of February, the growth rate of BTC prices slowed down, and in the last 30 days, it lowest traded at around $17,995.20.

The current rate of BTC was down by 68.48% from its all-time high of $68,789.63 achieved on November 10, 2021, while it was up by 32,983.68% up from its all-time low of $65.53 on July 05, 2013.

According to a media report, Coinbase is facing a US probe in the context that they were ineptly letting Americans trade the digital assets which would have been registered as securities.

Despite their statements explaining the difference, COIN stock dropped by almost 21.95%, the biggest drop since July 26. At the time of writing, it was trading at $57.09, dropping 4.26%, with the previous close at $59.63.The stock is trailing at the lower end of the spectrum. The market cap is strong at $12.96 billion.

ຂໍ້ສັງເກດ

ທັດສະນະແລະຄວາມຄິດເຫັນທີ່ຂຽນໂດຍຜູ້ຂຽນ, ຫຼືຄົນທີ່ມີຊື່ໃນບົດຄວາມນີ້, ແມ່ນສໍາລັບຄວາມຄິດທີ່ເປັນຂໍ້ມູນເທົ່ານັ້ນ, ແລະພວກເຂົາບໍ່ໄດ້ສ້າງຕັ້ງທາງດ້ານການເງິນ, ການລົງທຶນ, ຫຼືຄໍາແນະນໍາອື່ນໆ. ການລົງທຶນໃນຫຼືການຊື້ຂາຍຊັບສິນ crypto ມາພ້ອມກັບຄວາມສ່ຽງຂອງການສູນເສຍທາງດ້ານການເງິນ.

Source: https://www.thecoinrepublic.com/2023/02/11/coinbase-stock-plunges-after-secs-action-against-kraken/