It’s a good time to get the perspective of the recent market rally from legendary investor Bill Miller, who beat the S&P 500

SPX,

for 15 years in a row and has seen a cycle or two.

“No one knows how long the war in Ukraine will last nor what its outcome will be,” writes Miller in his latest market perspective. “No one knows how high inflation will go nor when it will begin to subside. No one knows if oil prices will stay over $100 or begin to decline or even double from here. No one knows how many times the Federal Reserve will raise rates nor what impact, if any, reducing its balance sheet will have on the economy.”

Miller attributed the change in sentiment to multiple factors: “market-friendly comments from Chinese officials, coupled with a well-signaled and discounted Fed rate hike of 25 basis points and some hope of progress for a negotiated settlement in the Russian war on Ukraine.” Perhaps that’s not much, but given the deep pessimism of short-term investors, it was enough.

Miller said there are many good values in the market, proceeding to tick off several.

A strong U.S. economy and a Fed that has started to lift rates will make it likely that a rotation to value from growth stocks has begun, while energy stocks don’t reflect oil prices in the $70s, much less $100s, he said. (The Miller Value Opportunity Fund he co-manages had Diamondback Energy

ຟາງ,

as its third-largest holding at the end of 2021.)

Chinese stock valuations are too low, particularly when the government is easing and wants to help the market. And housing stocks with valuations in the low-to-mid single digits don’t “reflect even a modest continuation of the current fundamentals, he said. (Taylor Morrison Home

TMHC,

was a top ten holding in the fourth quarter.)

Miller said airlines and cruise ships should see years of strong demand due to robust consumer balance sheets and a solid economy (Norwegian Cruise Line NCLH was a top ten holding at the end of 2021), and mega-cap tech leaders like Amazon

AMZN,

ແລະ Meta Platforms

FB,

also are attractive. He added that looking at a basket of names down 50% or more from their 52-week highs “will likely uncover some long-term bargains.”

ຕາຕະລາງ

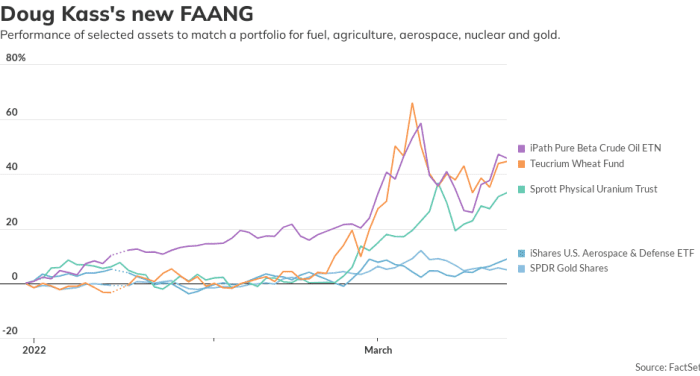

Doug Kass, the president of Seabreeze Partners Management, says there’s a new FAANG: F for fuel, one A for agriculture, another A for aerospace (as in aerospace and defense), N for nuclear and G for gold and critical metals.

A MarketWatch-compiled average of his new FAANG assets, equal weighted using popular exchange traded funds, yields a 27% return for 2022. Kass says he’s long the GLD exchange-traded fund and has invested in stocks in the other sectors, and expects supply/demand imbalances to keep boosting these themes.

ບ້ານໄດ້

President Joe Biden embarks on a four-day trip to Europe as the West weighs more sanctions against Russia, which kept up its offensive against Ukraine.

General Mills

GIS,

raised its sales outlook after beating earnings expectations. Adobe

ADBE,

late Tuesday reported slightly stronger-than-forecast earnings and revenue but issued current quarter guidance below expectations.

A badly damaged black box was found from the China Eastern Airlines Boeing

ບາ,

737-800 plane that crashed.

Microsoft

MSFT,

says the hacking group LAPSUS$, which has shared images of infiltrating Okta

OKTA,

was also able to infiltrate the computer software ຍັກໃຫຍ່.

Federal Reserve Chair Jerome Powell makes his third public comments in a week, this time on a Bank for International Settlements panel on emerging challenges in a digital world. Cleveland Fed President Loretta Mester late Tuesday proposed front-loading rate hikes. New-home sales data is due at 10 a.m. Eastern.

ຕະຫຼາດ

ຮຸ້ນອະນາຄົດຂອງສະຫະລັດ

ES00,

NQ00,

pointed to an opening pullback. The yield on the 10-year Treasury

TMUBMUSD10Y, ທ.

was at 2.38%, having surged 23 basis points over the previous two sessions. Crude-oil futures

CL.1,

traded above $111 per barrel.

ຍອດນິຍົມ

ນີ້ແມ່ນເຄື່ອງໝາຍຕິກເກີ້ຕະຫຼາດຫຼັກຊັບທີ່ເຄື່ອນໄຫວຫຼາຍທີ່ສຸດໃນເວລາ 6 ໂມງເຊົ້າຕາເວັນອອກ.

| Ticker | ຊື່ຄວາມປອດໄພ |

| GME, | GameStop |

| CMA, | AMC Entertainment |

| TSLA, | Tesla |

| ຫຼາຍ, | Mullen ຍານຍົນ |

| ບາບາ, | ອາລີບາບາ |

| HYMC, | ການຂຸດຄົ້ນບໍ່ແຮ່ Hycroft |

| AAPL, | ຈາກຫນາກແອບເປີ |

| CENN, | Cenntro ໄຟຟ້າ |

| TLRY, | ຍີ່ຫໍ້ Tilray |

| Nvda, | Nvidia |

Random ອ່ານ

Ash Barty, the top female tennis player in the world, retires at the ripe old age of 25.

ທ່ານ David Solomon ຜູ້ ອຳ ນວຍການໃຫຍ່ຂອງບໍລິສັດ Goldman Sachs is taking his DJ skills to Lollapalooza.

ຕ້ອງການຮູ້ເລີ່ມຕົ້ນແລະຖືກປັບປຸງຈົນກ່ວາລະຄັງເປີດ, ແຕ່ວ່າ ລົງທະບຽນຢູ່ທີ່ນີ້ ເພື່ອໃຫ້ມັນສົ່ງໄປທີ່ອີເມວຂອງທ່ານຄັ້ງດຽວ. ສະບັບອີເມວຈະຖືກສົ່ງອອກໃນເວລາປະມານ 7: 30 ເຊົ້າພາກຕາເວັນອອກ.

ຕ້ອງການເພີ່ມເຕີມສໍາລັບມື້ຂ້າງຫນ້າ? ລົງທະບຽນສໍາລັບ ໜັງ ສືພິມ Barron's Daily, ບົດລາຍງານສະຫຼຸບໃນຕອນເຊົ້າ ສຳ ລັບນັກລົງທືນ, ລວມທັງ ຄຳ ຄິດ ຄຳ ເຫັນສະເພາະຈາກນັກຂຽນ Barron ແລະ MarketWatch.

Source: https://www.marketwatch.com/story/investing-legend-bill-miller-says-there-are-many-good-values-in-the-market-even-after-relief-rally-11648033045?siteid=yhoof2&yptr=yahoo