ນ້ຳມັນມາຣາທອນ (MRO) looks like it is “off to the races” again as it has surged sharply higher in recent days. Let’s check the charts and indicators to see if we need to jump in now or wait awhile.

In this daily bar chart of MRO, below, we can see that the shares made a low in July and a higher low in September. Prices have rallied above the 50-day and the 200-day moving average lines.

Trading volume has been steady since July but the On-Balance-Volume (OBV) has quietly risen telling us that buyers of MRO are being more aggressive than sellers. The Moving Average Convergence Divergence (MACD) oscillator has made a higher low in September than July and is poised to cross to a new buy signal.

In the weekly Japanese candlestick chart of MRO, below, we can see lower shadows in July and again in September as traders are rejecting the lows. Prices are trading back above the rising 40-week moving average line.

The OBV line has been very stable since earlier this year and suggests to me that buyers of MRO have stayed long despite some corrections. The MACD oscillator has narrowed recently and thus could soon cross to the upside for a fresh outright buy signal.

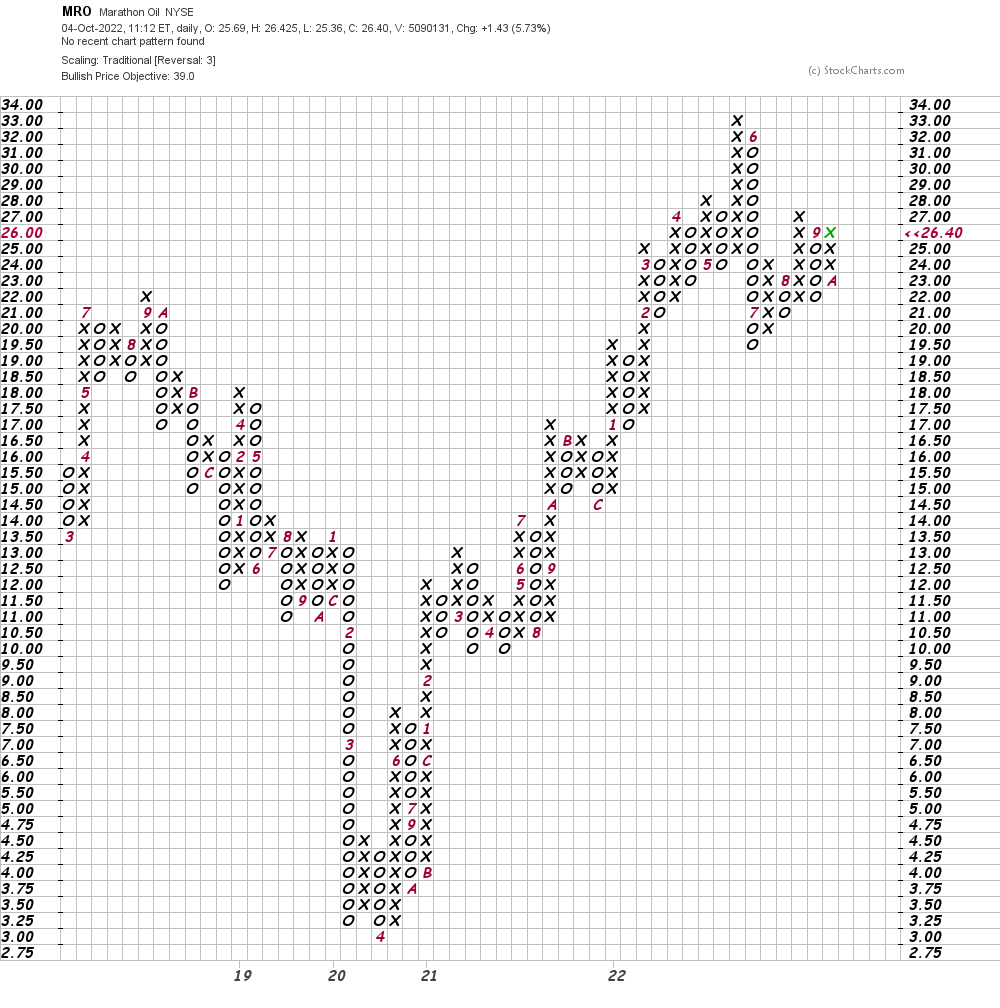

In this daily Point and Figure chart of MRO, below, we can see a potential upside price target in the $39 area.

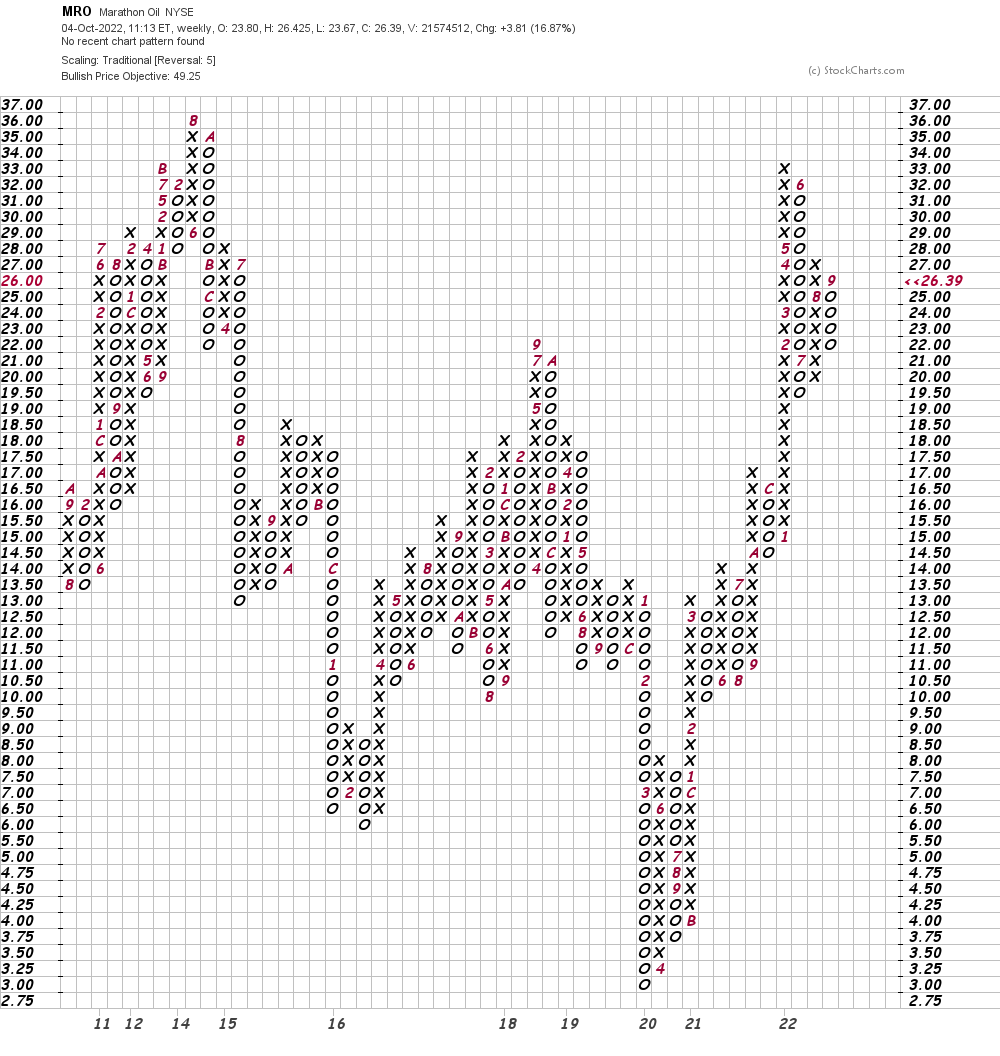

In this weekly Point and Figure chart of MRO, below, we used a five-box reversal filter. Here the chart points to a $49 price target.

ຍຸດທະສາດເສັ້ນທາງລຸ່ມ: Crude oil prices are firming and MRO should benefit. MRO could dip for a day or two but that should not hurt the chart picture. Traders could use this potential weakness to probe the long side of MRO, risk to $20. Our price targets are $39 and $49. Add to longs above $28.

ໄດ້ຮັບການແຈ້ງເຕືອນທາງອີເມວທຸກໆຄັ້ງທີ່ຂ້ອຍຂຽນບົດຄວາມ ສຳ ລັບເງິນທີ່ແທ້ຈິງ. ກົດປຸ່ມ“ + ຕິດຕາມ” ຕໍ່ກັບເສັ້ນທາງຂອງຂ້ອຍຕໍ່ບົດຄວາມນີ້.

Source: https://realmoney.thestreet.com/investing/stocks/marathon-oil-has-the-stamina-to-run-even-higher-16104289?puc=yahoo&cm_ven=YAHOO&yptr=yahoo