GlycoMimetics (GLYC) is a clinical-stage drug developer aiming to create what’s called glycobiology-based therapies for cancers.

This one has a catch, however. It’s a small biotech name. But despite an approximately $150 million market capitalization, options against this equity have decent liquidity and are quite lucrative. The company also has a lot of potential.

My main worry: That Glyco could get purchased for a significant premium in which case I might leave a lot of money on the table. Say la vie.

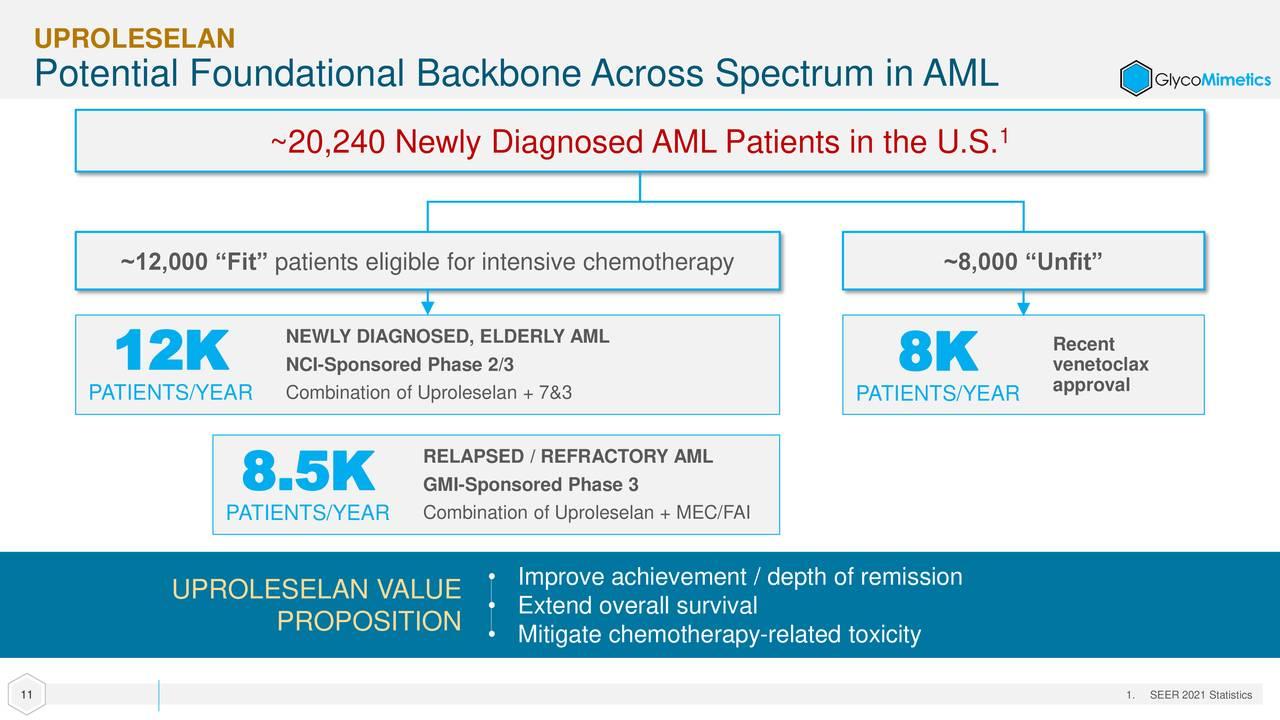

The company has one clinical asset, uproleselan, for acute myeloid leukemia and another one that is clinically cleared but looking for a development partner. Uproleselan has been granted “fast track” designation from the Food and Drug Administration, breakthrough therapy designations from regulatory authorities in the U.S. and China, and “orphan” designations from the FDA and the European Medicines Agency.

This candidate produced encouraging data in early clinical trials. Based on these results, uproleselan has been entered in multiple late-stage trials, including a double-blind, placebo-controlled phase 3 study to evaluate it in the treatment of 388 relapsed acute myeloid leukemia patients. The patients are randomized 1:1 to receive either an introductory round of uproleselan and chemotherapy, followed by three additional cycles of uproleselan and chemo — or an introductory round of placebo and chemo followed by three additional cycles of placebo and chemo.

The returns to date have been potentially groundbreaking. The overall survival event trigger was initially anticipated at around 22 months — excellent considering that Astellas’ (ALPMF) Xospata and Jazz Pharmaceuticals’ (JAZZ) Vyxeos were approved with median over survival rates of 9.3 months and 9.5 months, which were triggered at 17.8 months and 20.5 months, respectively. However, in an update provided in November 2022, management indicated that median follow-up is now anticipated to be triggered at 34.5 months, providing significant improvement over the other two therapies.

In fact, the news was so encouraging that the FDA elected to conduct a utility analysis in which an independent data monitoring committee will review data at 80% of planned events by the end of the first quarter of 2023 to determine if the study should proceed to 100% events triggered (near year-end 2023) or unblind the data early due to compelling evidence of benefit. An unblinding would trigger an immediate new drug application filling by the company. This disclosure has triggered a significant and justified rally in the stock over the past few months.

Furthermore, GlycoMimetics’ compound is being assessed as a front-line therapy in a 262-patient Phase 2/3 study in which newly diagnosed individuals will be randomized to receive either an introductory round of uproleselan and chemo followed by three rounds of uproleselan and chemo -OR- an introductory round of chemo followed by three rounds of chemo. The Phase 2 portion was fully enrolled in December 2021 with an interim readout expected sometime in 2023.

The company ended the third quarter with just over $50 million worth of cash and marketable securities on its balance sheet. This should fund it through 2023, but I would not be surprised if the company raises additional capital in the next quarter or two. If I were the CFO, I would probably execute that raise, if the FDA unblinds the study which sometime this quarter.

ຍຸດທະສາດທາງເລືອກ:

Accumulate a position in GLYC using a covered call strategy. Selecting the June $2.50 call strikes, you will fashion a covered call order with a net debit in the $1.60 to $1.70 a share range (net stock price – option premium). This strategy provides downside protection of nearly 35% and 50% of upside potential even if this stock does nothing over the option duration.

(ກະລຸນາຮັບຊາບວ່າເນື່ອງຈາກປັດໃຈລວມເຖິງການລົງທືນຂອງຕະຫຼາດຕໍ່າ ແລະ/ຫຼື ການລອຍຕົວຂອງສາທາລະນະບໍ່ພຽງພໍ, ພວກເຮົາຖືວ່າຫຼັກຊັບນີ້ເປັນຫຼັກຊັບຂະໜາດນ້ອຍ. ທ່ານຄວນລະວັງວ່າຮຸ້ນດັ່ງກ່າວມີຄວາມສ່ຽງຫຼາຍກວ່າຮຸ້ນຂອງບໍລິສັດໃຫຍ່, ລວມທັງຫຼາຍກວ່າເກົ່າ. ການເໜັງຕີງ, ສະພາບຄ່ອງທີ່ຕໍ່າກວ່າ ແລະຂໍ້ມູນທີ່ມີໃຫ້ສາທາລະນະໜ້ອຍລົງ, ແລະການປະກາດຂ່າວດັ່ງກ່າວສາມາດສົ່ງຜົນກະທົບຕໍ່ລາຄາຫຸ້ນຂອງເຂົາເຈົ້າ).

ໄດ້ຮັບການແຈ້ງເຕືອນທາງອີເມວທຸກໆຄັ້ງທີ່ຂ້ອຍຂຽນບົດຄວາມ ສຳ ລັບເງິນທີ່ແທ້ຈິງ. ກົດປຸ່ມ“ + ຕິດຕາມ” ຕໍ່ກັບເສັ້ນທາງຂອງຂ້ອຍຕໍ່ບົດຄວາມນີ້.

Source: https://realmoney.thestreet.com/investing/options/this-small-pharma-company-could-develop-into-a-nice-trade-16114058?puc=yahoo&cm_ven=YAHOO&yptr=yahoo