Optimism from a bullish start to the week is set to spill over into Tuesday’s session, with stock futures tearing higher. That’s as Goldman Sachs — and Netflix later — will keep the earnings ball rolling.

Some are attributing the positive mood to a report that the Bank of England may shelve a quantitative tightening plan, with hopes the Fed could follow. Others say, short covering, technical flows, yadda yadda.

At the end of the day, all that is just a distraction for investors who really need to focus on a portfolio’s stock picks, as Daniel Gladis, founder of the Malta-based Vltava fund, reminds clients in his recently-published third-quarter letter.

And in our ໂທຂອງມື້, Gladis says investors need to get Berkshire Hathaway

BRK.A,

BRK.B,

in their portfolio if they haven’t already. Warren Buffett’s conglomerate has been Vltava’s oldest position — 11 years — and mostly largest throughout that time.

“If I had to invest all my money in a single stock and could not touch it at all for 5–10

years, then I would choose BRK without any hesitation,” he writes, noting the conglomerate’s investments are above average as far as quality, efficiency in capital allocation and balance sheets, as well as offering low-business risk.

Gladis says Berkshire’s earnings power is somewhere atop $50 billion per year, giving the entire company a market capitalization of $590 billion, and leaving it to trade at less than 12 times annual earnings.

“It is very realistic to expect BRK’s stock price to grow at an average rate of about

10% per year over the long term. This is considerably greater than what with equal

realism can be expected from the stock markets generally,” he says.

“Thus, we look for Berkshire’s stock to continue in beating the S&P 500 index

SPX,

and to do so at much lower risk than that of the index as a whole,” he says. Berkshire shares are down just over 7% year to date, versus a 22% drop for the S&P.

Gladis also highlights Markel

MKL,

a holding company for insurance, reinsurance and investments that is one of the few out there following in Berkshire’s footsteps.

“Markel can be said to be some 30 years behind Berkshire Hathaway in its development. Therefore, it still has a lot of room for growth in the coming decades and it has one undeniable advantage over BRK. That is, its smaller size,” says Gladis.

Berkshire’s massive market capitalization and total assets of $900 billion will likely slow future growth, whereas with just $15 billion on the former, Markel has lots of room to grow, says the manager.

What else does the Malta-based fund like? BMW

bmw,

“the best managed car company,” in a sector struggling with semiconductor shortages. A scarcity of its autos on the market “is more than compensated by the high margins that are currently enabling BMW to make new-record profits,” says Gladis, adding that with the auto maker’s shares trading at 4 times forward earnings, investors can expect buybacks.

CVS Health

CVS,

is another pick, which they brought into the fund during prepandemic lows. A stable and profitable company, strong free cash flow, revenues of $300 billion and a focus on reducing debt over the past few years are all winning points. Trading at about 11 times forward earnings, valuation is also appealing, says the manager.

They also like “the strongest and best-managed bank in the world” — JPMorgan Chase

ບໍລິສັດ JPM,

which reported forecast-beating results last week. “JPM has been very profitable even during years when interest rates were close to zero. The current – and perhaps not temporary – return to somewhat more normal, higher interest rates should have a significantly positive impact on the bank’s

interest income and overall profitability,” said Gladis.

Finally, the fund also owns Lockheed Martin

LMT, ທ.

which has been in the spotlight this year as Russia’s invasion of Ukraine reminded the world of the need for defense companies. It’s one of a few large firms that play a dominant role in that sector, and its key customer is the U.S. Plus, part of its production is classified as secret, meaning a further edge.

ຕະຫຼາດ

ອະນາຄົດຂອງຫຸ້ນ

ES00,

YM00,

NQ00,

are surging, with bonds

TMUBMUSD10Y, ທ.

TMUBMUSD02Y, ທ.

calm and the dollar

DXY,

softer. Oil prices

CL.1,

BRN00, ທ.

are also firmer, while bitcoin

BTCUSD, ທ.

is trading just under $19,000.

ອ່ານ: 11 stocks tolead your portfolio’s rebound after an earnings recession and market bottom

ບ້ານໄດ້

Johnson ແລະ Johnson

JNJ,

reported an earnings beat, but trimmed its outlook. Goldman Sachs’

GS,

per share earnings fell, but beat forecasts.Lockheed Martin

LMT, ທ.

reported mixed results and an additional $14 billion share buyback plan. United

UAL,

followed by Netflix

NFLX,

ຫຼັງຈາກປິດ.

Microsoft

MSFT,

ລາຍງານວ່າມີແຜນທີ່ຈະ cut nearly 1,000 jobs.

Intel

ບໍລິສັດ INTC,

-owned Mobileye Global

MBLY,

ມີ priced its IPO, and sees shares trading at $18-$20, valuing it at up to $15.9 billion.

Industrial production and capacity utilization are due at 9:15 a.m., followed by the National Association of Home Builder’s sentiment index. Atlanta Fed Pres. Raphael Bostic will speak at 2 p.m. Eastern and Minneapolis Fed. Pres. Neel Kashkari at 5:30 p.m.

ດີທີ່ສຸດຂອງເວັບ

How Switzerland’s oldest bank turned into a meme stock.

Cisco gear is being shipped into Russia from China, leaked customs database shows

ຕາຕະລາງ

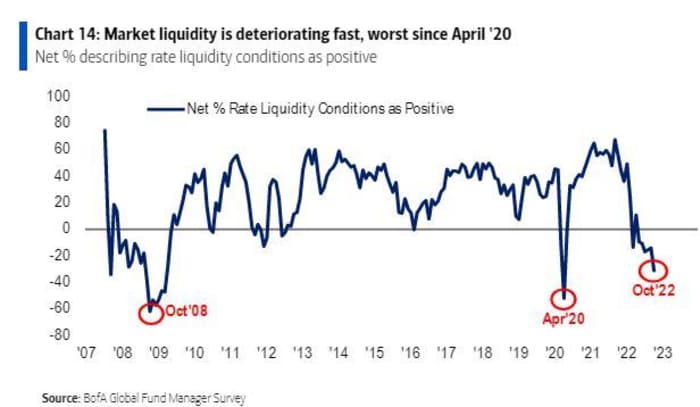

Fresh off the presses, Bank of America’s monthly fund manager report found that cash levels for fund managers were ສູງສຸດໃນ 21 ປີ. It also added another voice to those worried about market liquidity. Here’s that chart:

ທະນາຄານອາເມລິກາ

ປີ້

ເຫຼົ່ານີ້ແມ່ນ tickers ທີ່ມີການຄົ້ນຫາສູງສຸດໃນ MarketWatch ໃນເວລາ 6 ໂມງເຊົ້າຕາເວັນອອກ:

| Ticker | ຊື່ຄວາມປອດໄພ |

| TSLA, | Tesla |

| GME, | GameStop |

| CMA, | AMC Entertainment |

| APE, | AMC Entertainment ມັກຮຸ້ນສ່ວນ |

| ເດັກຊາຍ, | NIO |

| AAPL, | ຈາກຫນາກແອບເປີ |

| ບີບີ, | ຫ້ອງນອນແລະນອກ ເໜືອ ໄປ |

| AMZN, | Amazon |

| Nvda, | Nvidia |

| ຫຼາຍ, | Mullen ຍານຍົນ |

Random ອ່ານ

An unfortunate mishap at Japan’s oldest toilet.

Nothing’s tougher than a Lapland bumblebee queen.

ຕ້ອງການຮູ້ເລີ່ມຕົ້ນແລະຖືກປັບປຸງຈົນກ່ວາລະຄັງເປີດ, ແຕ່ວ່າ ລົງທະບຽນຢູ່ທີ່ນີ້ ເພື່ອໃຫ້ມັນສົ່ງໄປທີ່ອີເມວຂອງທ່ານຄັ້ງດຽວ. ສະບັບອີເມວຈະຖືກສົ່ງອອກໃນເວລາປະມານ 7: 30 ເຊົ້າພາກຕາເວັນອອກ.

ເຊີນຟັງ ແນວຄວາມຄິດໃໝ່ທີ່ດີທີ່ສຸດໃນ Money podcast ກັບນັກຂ່າວ MarketWatch Charles Passy ແລະນັກເສດຖະສາດ Stephanie Kelton

Source: https://www.marketwatch.com/story/want-to-keep-beating-the-s-p-500-and-at-much-lower-risk-bet-on-buffett-and-perhaps-this-younger-clone-says-this-fund-manager-11666090490?siteid=yhoof2&yptr=yahoo