ຂໍ້ມູນວິເຄາະໂດຍ CryptoSlate ສະແດງໃຫ້ເຫັນຄວາມກົງກັນຂ້າມທີ່ເຂັ້ມແຂງລະຫວ່າງ Bitcoin ແລະ Ethereum Spot to Futures Volume (SFV) ແນວໂນ້ມ, ກັບ SFV ຂອງອະດີດສືບຕໍ່ເພີ່ມຂຶ້ນ.

Spot to Futures Volume metric ເບິ່ງອັດຕາສ່ວນຂອງປະລິມານຈຸດຕໍ່ກັບປະລິມານໃນອະນາຄົດສໍາລັບ cryptocurrency ໂດຍສະເພາະ.

ລາຄາຈຸດຫມາຍເຖິງການອ້າງອິງໃນປັດຈຸບັນສໍາລັບການຊື້ທັນທີທັນໃດຂອງ cryptocurrency ແລະປະກອບເປັນພື້ນຖານສໍາລັບຕະຫຼາດອະນຸພັນທັງຫມົດ. ປະລິມານຈຸດທີ່ເຂັ້ມແຂງເທົ່າກັບການສະສົມທີ່ມີສຸຂະພາບດີ, ນໍາໄປສູ່ການເຕີບໂຕຂອງລາຄາທີ່ຍືນຍົງ.

ຜູ້ຊື້ຂາຍຍ່ອຍໂດຍປົກກະຕິໃຊ້ຕະຫຼາດຈຸດ, ໃນຂະນະທີ່ສະຖາບັນແລະຜູ້ຄ້າທີ່ມີປະສົບການ, ການເງິນດີມີແນວໂນ້ມທີ່ຈະເຮັດການຄ້າອະນຸພັນ.

Bitcoin vs. Ethereum Spot to Futures Volume

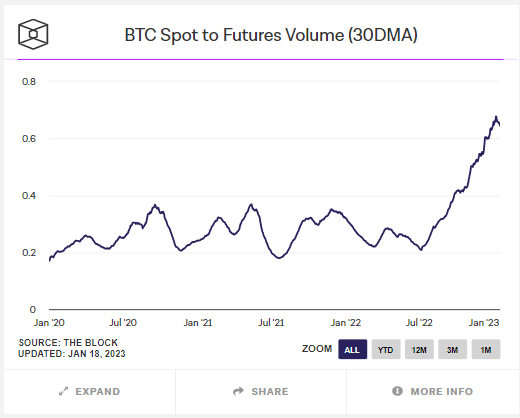

Per the chart below, the Bitcoin SFV has oscillated relatively uniformly between 0.2 and 0.4 since January 2020. However, the SFV broke out of this range last summer, climbing higher to peak at just under 0.7 this week.

In other words, Bitcoin spot volume is rising in proportion to futures volume, suggesting retail traders are piling in at a rate greater than derivatives traders.

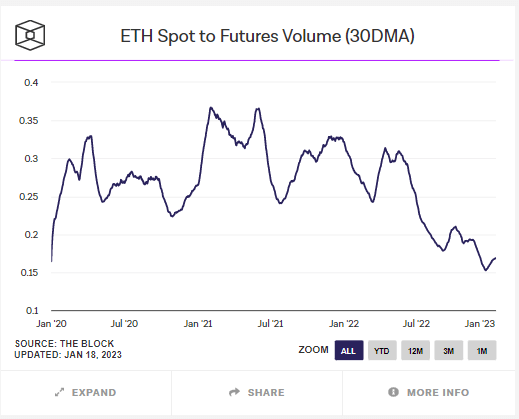

In contrast, the Ethereum SFV print shows a more haphazard pattern. Unlike the previous example, the ratio of the spot to futures volume has been recording lower lows since May 2022, with the latest low coming in at 0.15.

This would imply institutions and professional traders continue to dominate ETH markets.

The derivatives market

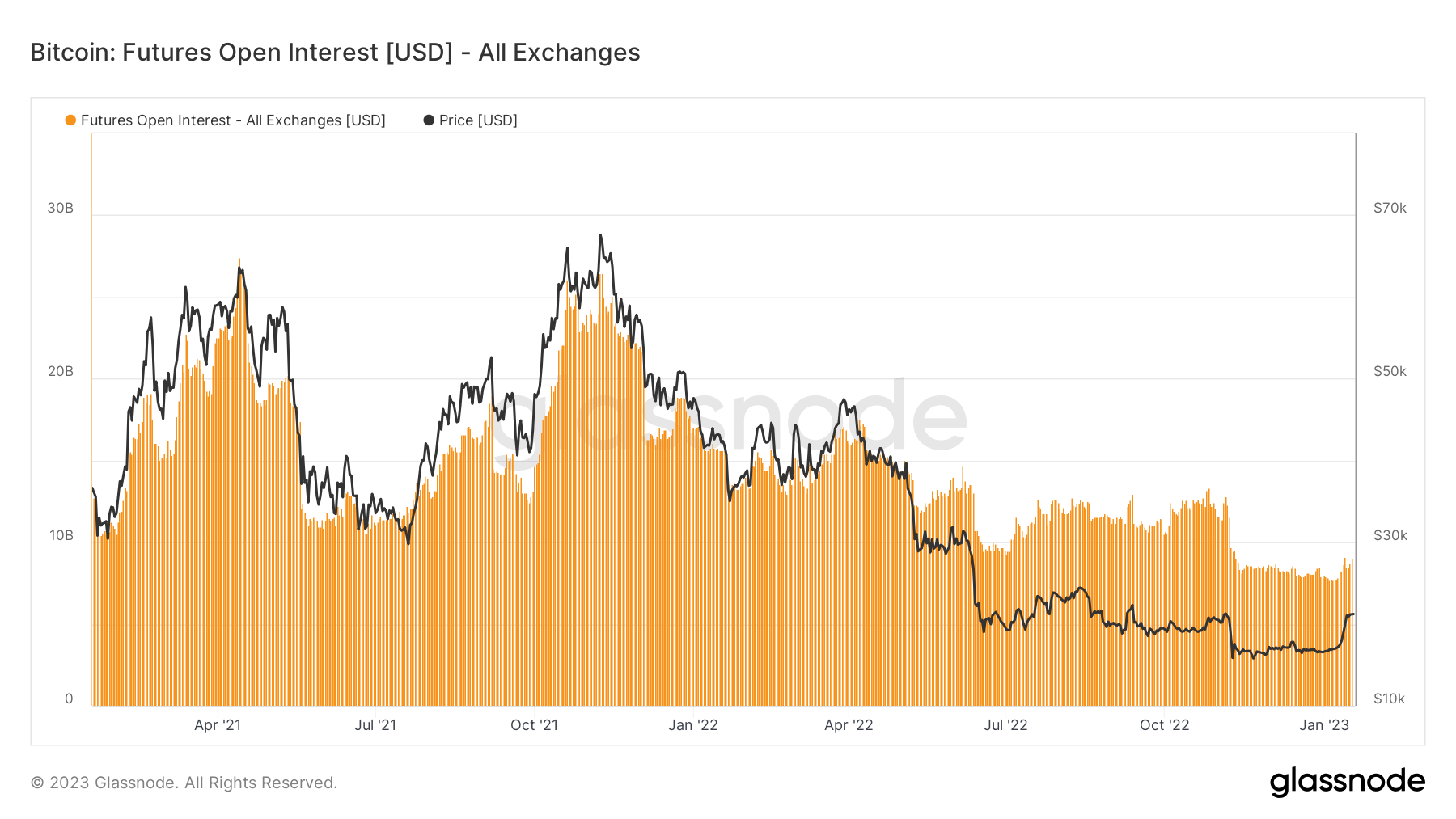

The crypto derivatives market (along with covid stimulus) was a factor in buoyant spot prices during 2021.

For example, the chart below shows Futures Open Interest hitting over $25 billion on three occasions in 2021, coinciding with spikes in the spot price to $64,670, $67,100, and $69,200. It was likely that the leverage used in derivatives trading influenced spot exuberance at the time.

However, Futures Open Interest has dropped significantly since November 2021. Further, for unknown reasons, the relationship between Open Interest and spot price came undone around May 2022.

Based on this, retail buyers had a significant hand in Bitcoin’s recent resurgence back above the psychological $20,000 level.

Source: https://cryptoslate.com/research-bitcoin-spot-to-futures-ratio-shows-retail-drove-price-above-20000/